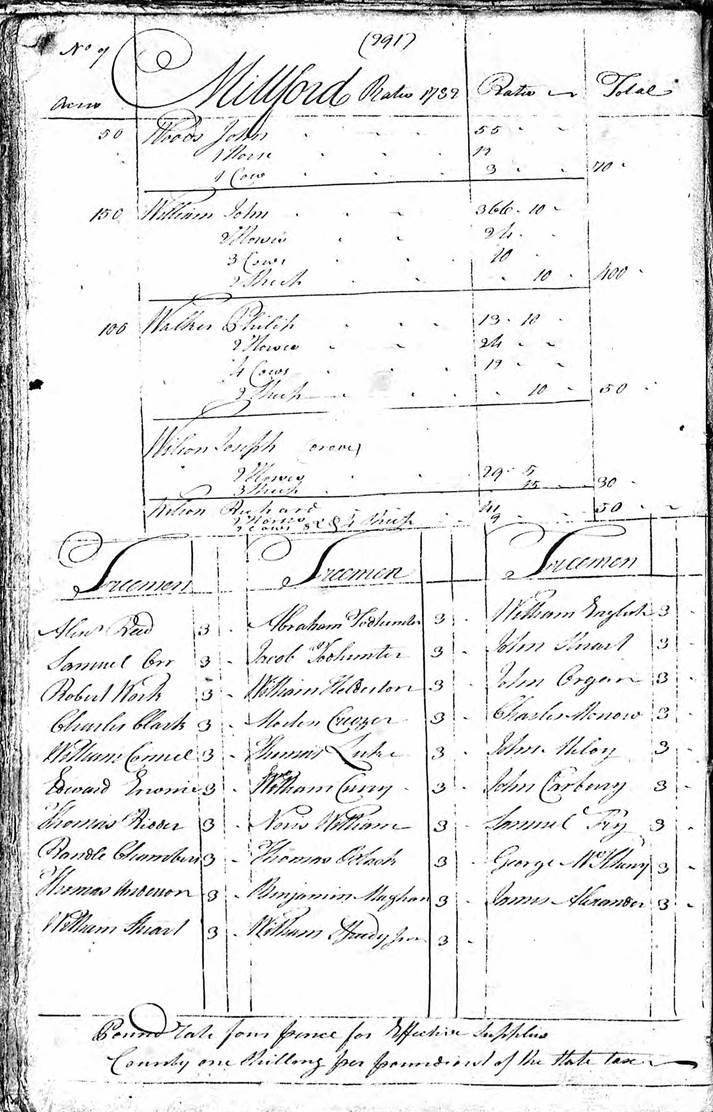

Milford

Township, Cumberland County, Pennsylvania, Tax Lists, 1778-1782

David Ralston,

Alexander Reid, Sr., and Alexander Reid, Jr.

During this period in Pennsylvania, taxes were

based on property with the potential to produce income. This included acreage, horses, cows, trade

goods, stills, slaves, etc. The tax

rates were subjective based on the quality of the property. Note on the forms, for example, that not all acres horses, cows or stills were taxed the same.

From: 18th

Century Tax - Chester County:

“There are four categories of taxables:

1. landholder – held land by lease or

deed (PA taxed the occupant)

2. inmate – married or widowed,

landless (contract labor)

3. freeman – single, free man at least 21 years of age (as of 1718). Had to be

out of servitude or apprenticeship at least 6 months at time of tax. Taxation

of freemen was inconsistent. It appears that before 1755 single men living with

their parents were not taxed.

4. nonresident landowner – owner of

unseated (unoccupied) land”

So, for tax purposes, David

Ralston and Alexander Reid, Sr., would be considered landholders and each was

taxed for acreage held and other assets.

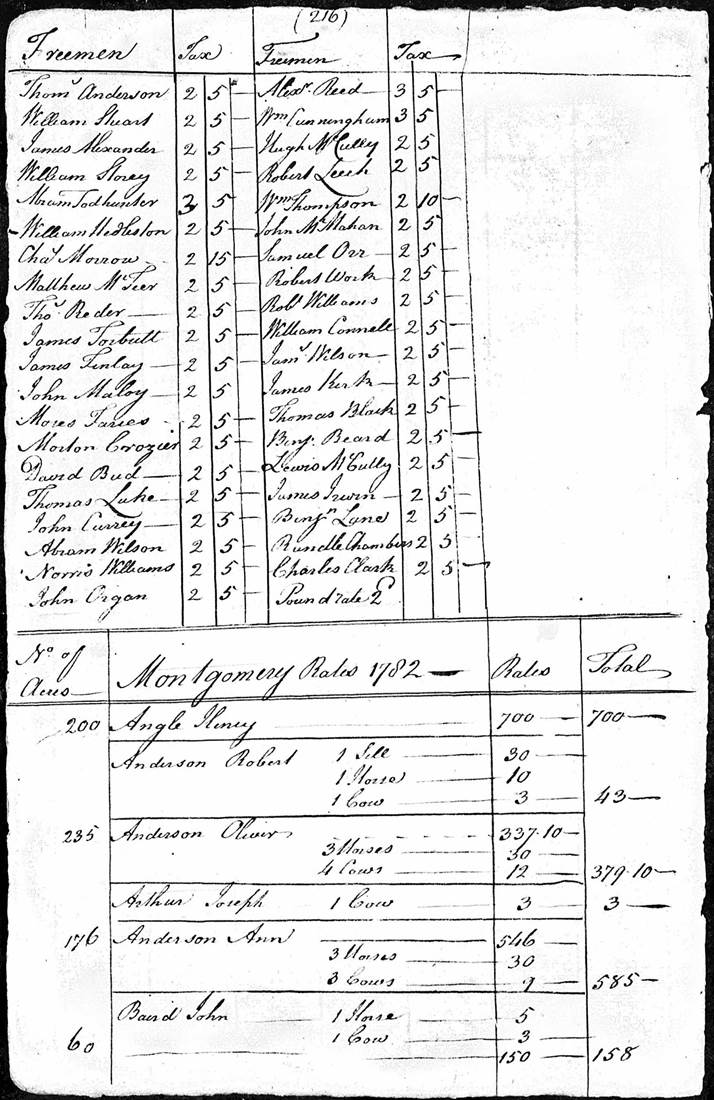

Alexander, Jr., was considered a “freeman” and is included in a “Freemen”

list at the end of each township’s taxables. Alexander Reid, Jr., is listed as a freeman

at the end of the 1778 list, but David and Alexander, Sr., are not listed. I conclude that this was the year that the Reids and David Ralston came to Milford and that they had

not yet acquired land there. A step

further conclusion is that David and Mary were already married at that time,

since David was not listed among the “Freemen”.

From

Pennsylvania’s Tar-Baby: The Property Tax and Its Endless Reform:

“From the time the Commonwealth of Pennsylvania

was established with the Constitution of 1776 on through the early 1800s,

property taxes still brought the disdain of most land owners. Fair and

equitable assessments remain a key issue with frequent disagreements on the how

much the land would be capable of producing. During this time Allegheny,

Fayette, Washington, and Westmoreland Counties opted to change the manner of

the valuation of land, from the potential wealth it could produce in a year, to

the actual value of the land if it was sold, thereby creating the state’s first

ad valorem property tax. Altogether, this was considered more equitable and

over the decade was adopted by all Pennsylvania Counties. Furthermore, since

cash was in short supply, counties permitted farmers to pay their property

taxes in like value of whiskey, which the county could than sell to taverns and

inns, or sometimes even export to other states. Interestingly, this became one

of the main reasons for the adverse reaction to the first national tax, which

was on whiskey, and became one of the reasons for the Whiskey Rebellion.”

So, since Pennsylvania taxed the “holder” of

the land, not necessarily the owner, it is unknown whether David Ralston or

Alexander Reid, Sr., owned or leased the acreage for which they were taxed. But, since the amount of acreage varied each

year (especially in the case of Alexander Reid) it is a good assumption that

they were leasing the land.

Also, of note, Alexander Reid, Jr., was listed

as a distiller. Whiskey was apparently

used as a second currency at that time, so it might be used not only to sell

for cash, but to barter and pay taxes.

Notes on individual years

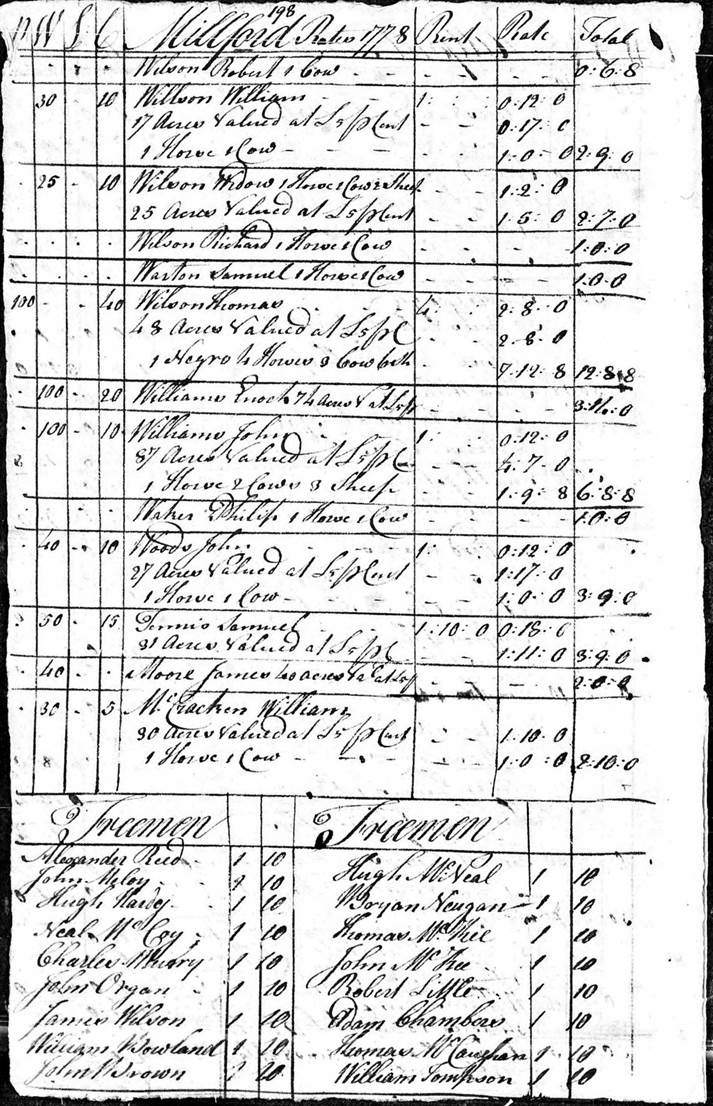

1778 Alexander

Reid (Jr) is listed as a freeman, but neither he, his father, nor David Ralston

are listed as property holders. This

might mean that in 1778 they had just come to this area and that arrangements

to obtain land had not yet been made. It

also would indicate that David Ralston and Mary were already married at this

time, since David was not listed as a freeman.

Tax for Alexander was £1 10s.

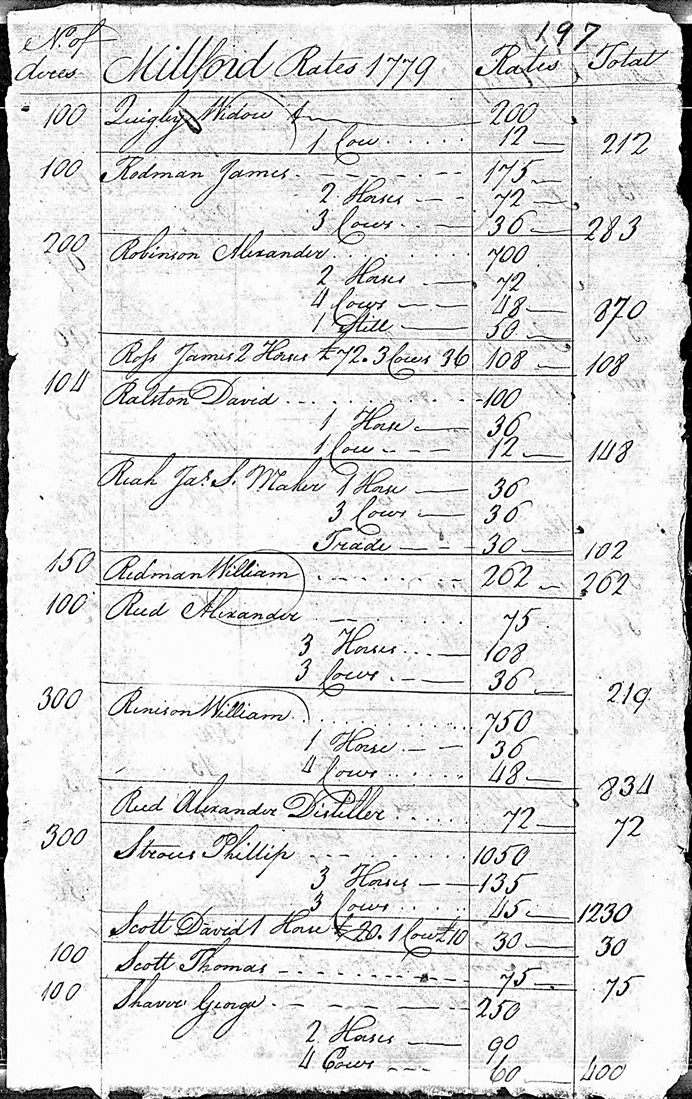

1779 David Ralston is listed holding 104 acres,

one horse and one cow, total tax - £148

Alexander

Reid, Sr., is listed holding 100 acres, three horses and three cows - £219

Alexander Reid, Jr., is listed as

a distiller - £72 and as a freeman - £12

1780 David Ralston is listed holding 134 acres,

two horses and two cows, total tax - £1710

Alexander

Reid, Sr., is listed holding 50 acres, three horses and four cows - £1630

Alexander,

Jr., is listed with ½ still (half interest?) - £360 and as a freeman - £20 7s

6d

Taxes for 1780 seemed considerably

higher that other years, but at this time during the use of continental

currency there was great inflation and fluctuation in value.

1781 David Ralston is listed holding 134 acres,

two horses and one cow, total tax - £414

Alexander

Reid, Sr., is listed holding 20 acres, two horses and three cows - £460

Alexander, Jr., is only listed as

a freeman - £55

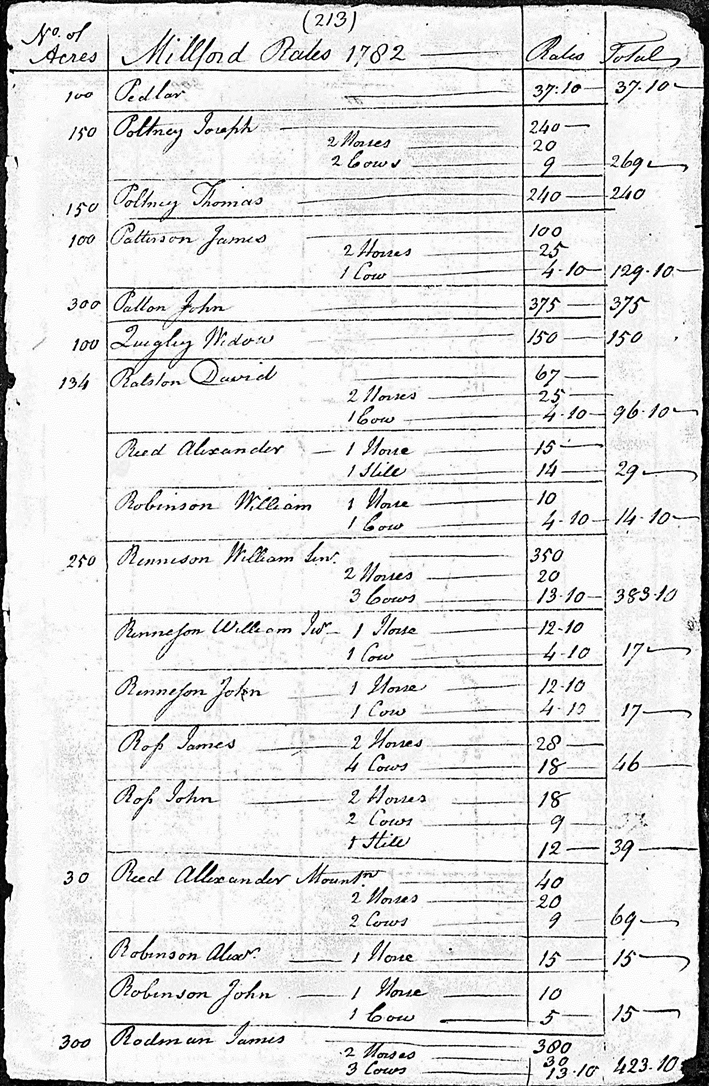

1782 David Ralston is listed holding 134 acres,

two horses and one cows, total tax - £96 10s

(1st) Alexander

Reid, Sr., is listed holding 30 acres, two horses and two cows - £69

Alexander, Jr., is listed with one

horse and one still - £29 and as a freeman - £3 5s

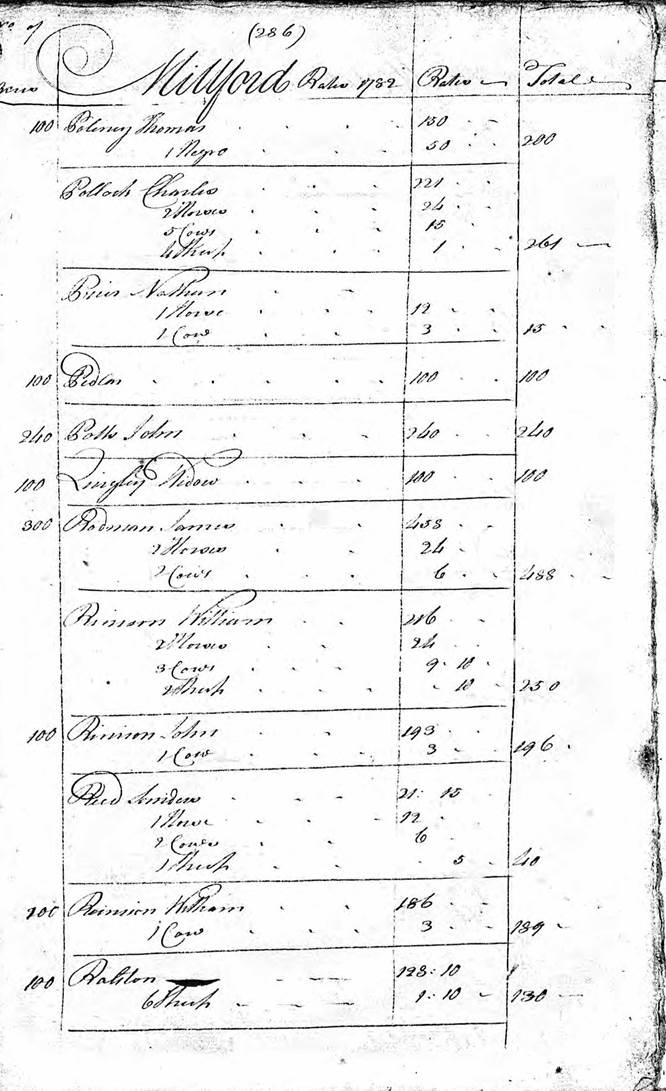

1782 “Ralston” is listed holding 100 acres and

six sheep, total tax - £130

(2nd) Alexander

Reid, Sr., is not listed, however, the Reid two entries before “Ralston” may be

Alex, Sr. No acreage was entered, but

there is a tax for land (£21 ¾), one horse, two cows and one sheep – total £40

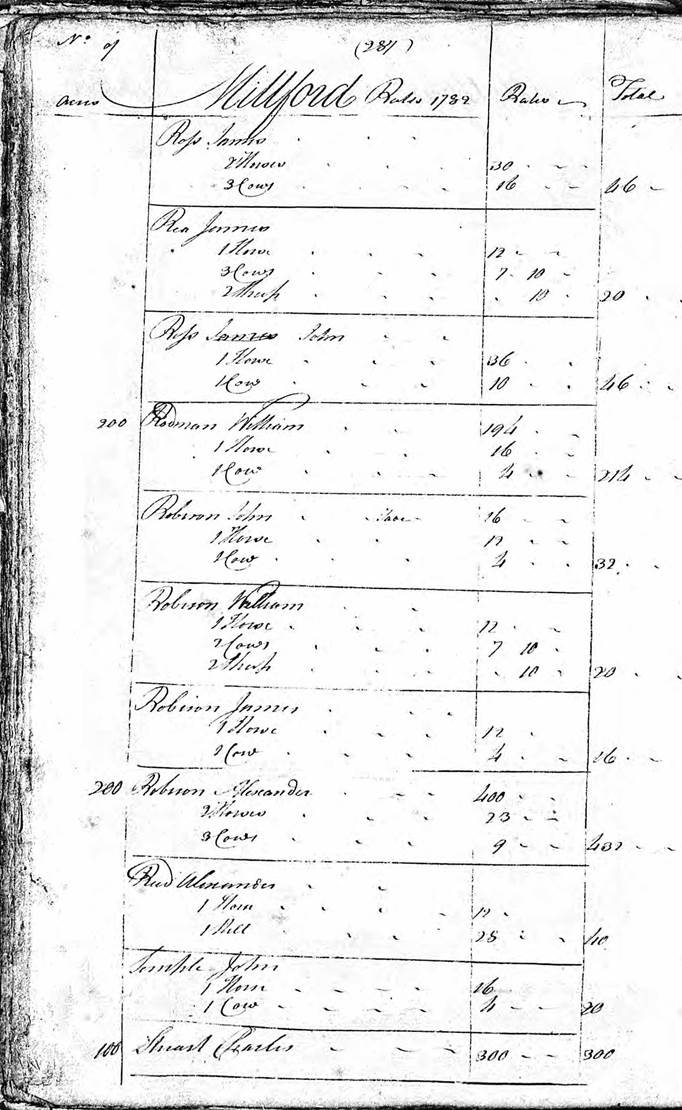

Alexander, Jr., is listed with one

horse and one still - £40 and as a freeman - £3

There is no given explanation for the two

separate lists for 1782. There are many

differences in the lists. Other 1782 tax

lists in the area have only one list and are more in the format of the 2nd

list, including sheep as taxable. (Prior years did not include sheep.) One possibility is that after the first 1782

Milford list was completed, either the rules changed or it was discovered the

person completing the list had done in incorrectly, and a second list had to be

done at a later date.

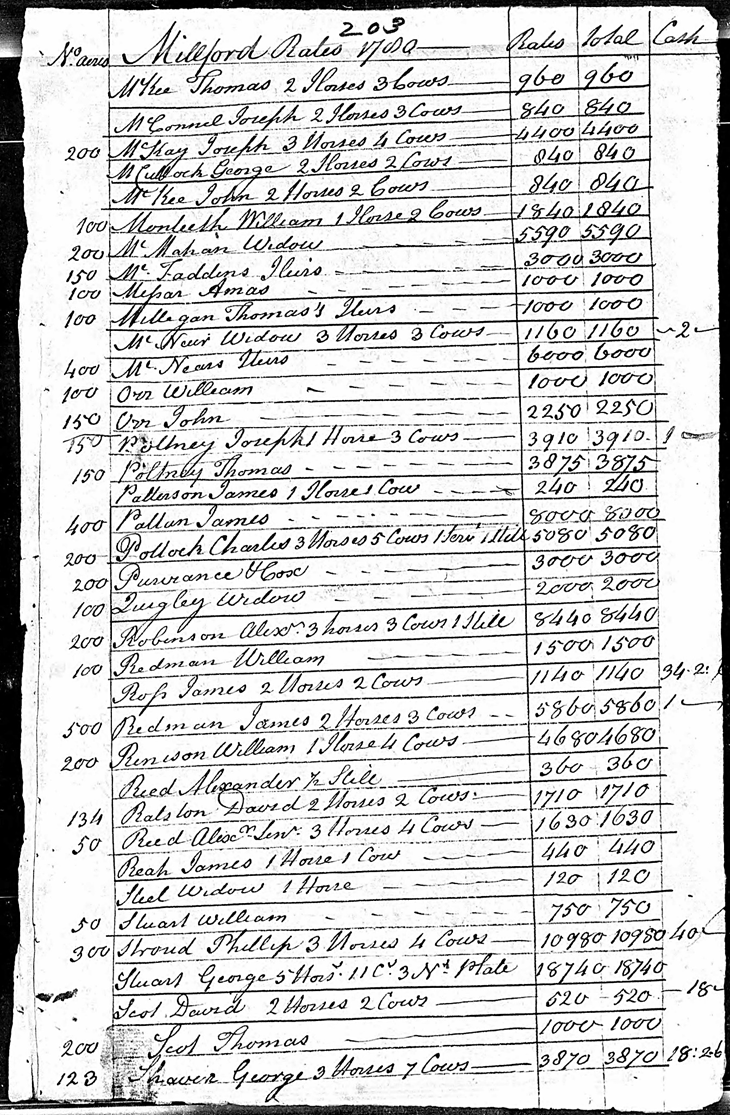

1778 Milford Township,

Cumberland County, Pennsylvania, Tax List

1779 Milford Township,

Cumberland County, Pennsylvania, Tax List

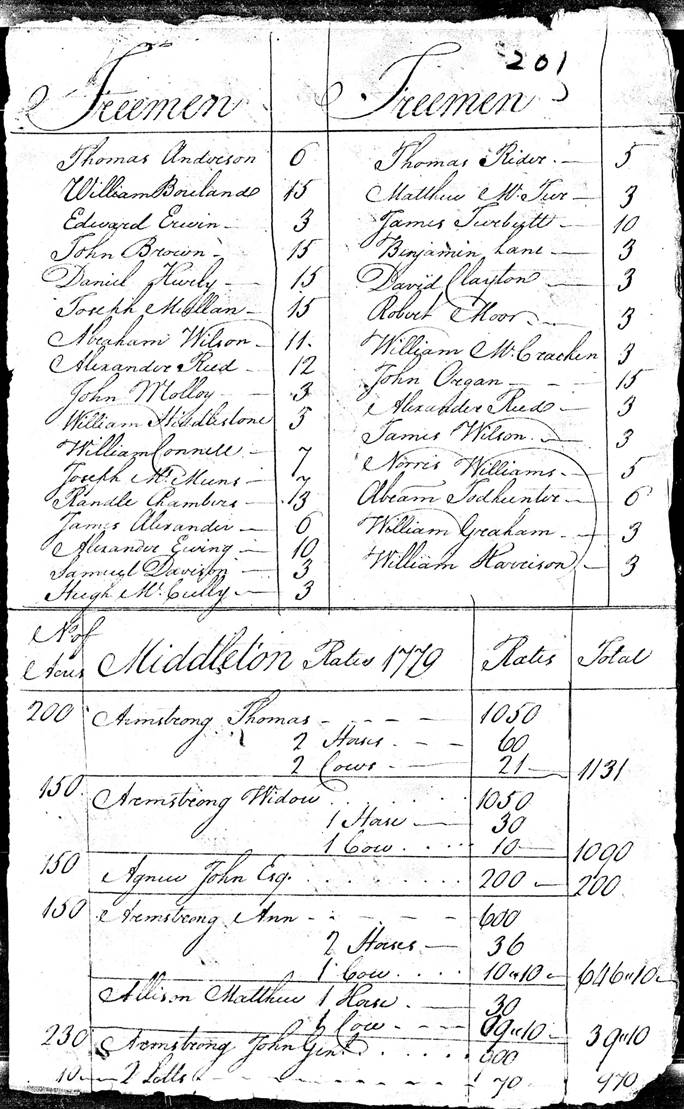

1779

Milford Freemen

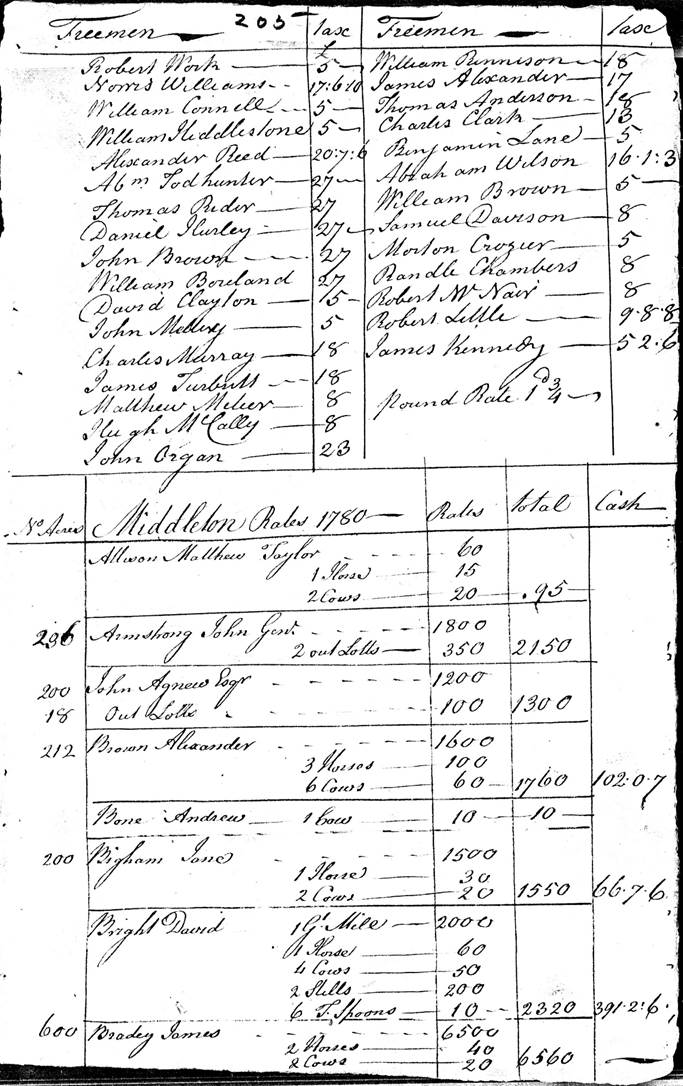

1780 Milford Township,

Cumberland County, Pennsylvania, Tax List

1780

Milford Freemen

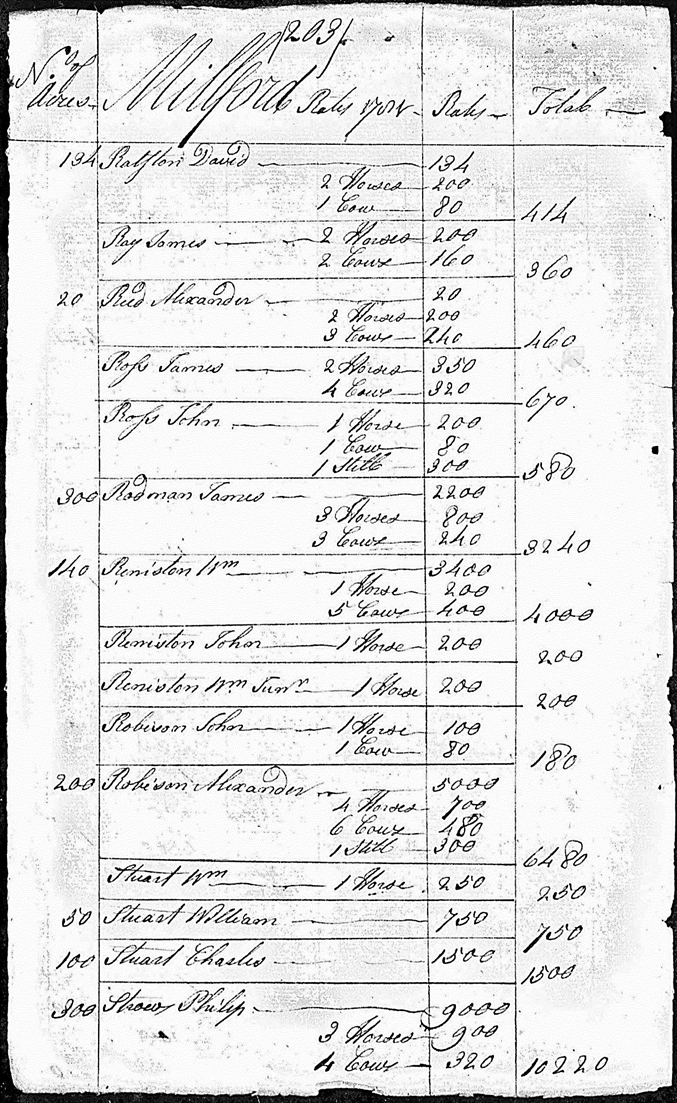

1781 Milford Township,

Cumberland County, Pennsylvania, Tax List

1781 Milford Freemen

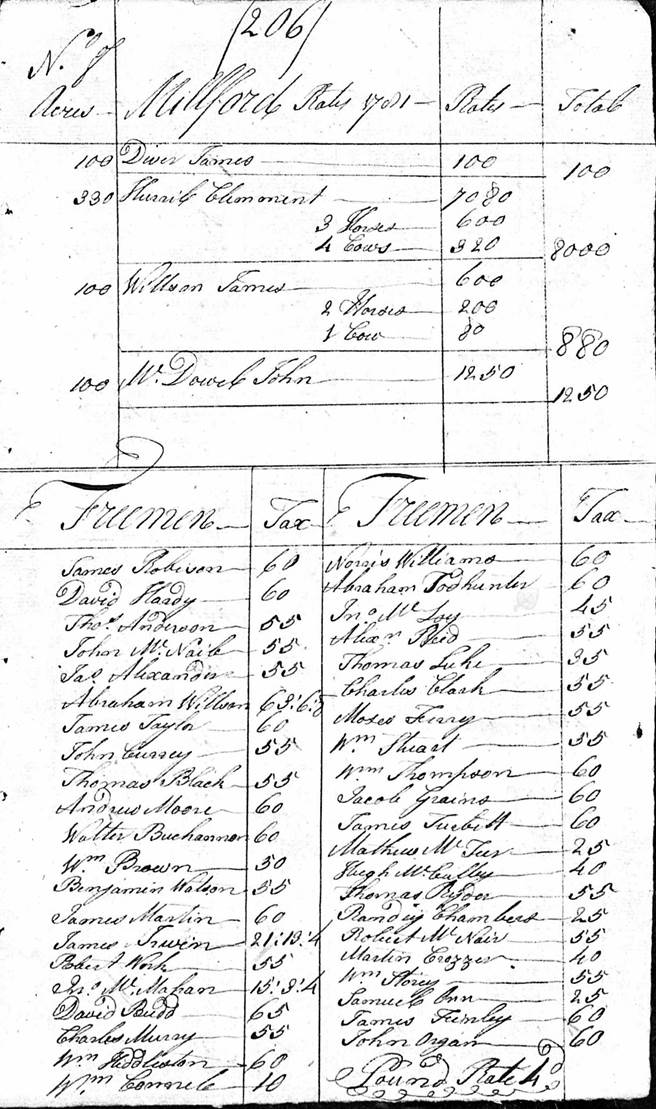

1782 Milford Township,

Cumberland County, Pennsylvania, Tax List

1782 Milford Freemen

1782 Milford Township, Second

Tax List (David Ralston)

1782 Milford Township, Second

Tax List (Alex Reid, Jr.)

1782 Milford Township, Second

Tax List – Freemen